Little Known Facts About Retirement Planning.

Some Of Retirement Planning

Table of ContentsThe Best Strategy To Use For Retirement PlanningSome Ideas on Retirement Planning You Need To KnowThe Single Strategy To Use For Retirement PlanningGetting The Retirement Planning To WorkThe Greatest Guide To Retirement PlanningRetirement Planning Things To Know Before You Get This

A 401(k) match is also an extra affordable method to use a financial motivation to your workers, as your company will be paying less in payroll taxes than if you provided a conventional raise or incentive, as well as the employee will certainly also obtain more of the money since they won't need to pay supplemental revenue tax obligation - retirement planning.As an example, 1. 5% may not appear like much, but simply an interest substances, so do fees. This cash is instantly deducted from your account, so you might not instantly see that you can be conserving hundreds of bucks by relocating your properties to a low-priced index fund, or switching carriers to one with lower investment charges.

If you have particular retirement accounts where you can add with funds with tax obligations you've paid currently vs. paying taxes upon the withdrawal of the funds in retired life, you may want to assume about what would conserve you more in tax repayments over time. If you have particular shorter term financial investment accounts, assume about exactly how much cash you 'd spend there (and also consequently pay taxes on in the near future) vs.

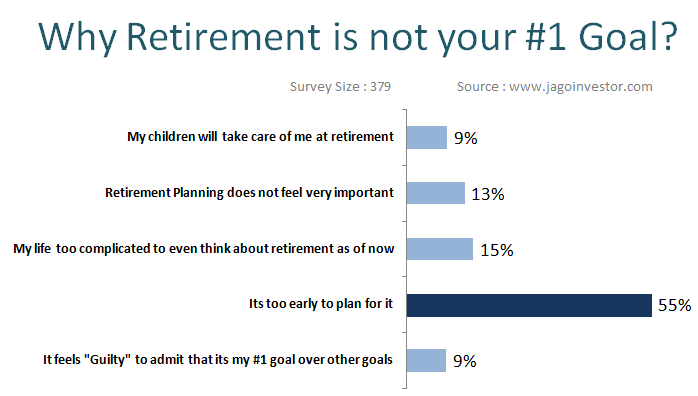

Listen to pay attention: Before we prior to discussing how talking about just how for a successful retirement, we need to understand what recognize retirement planning retired life why and also it important?

We think that instead of feeling the pinch post-retirement, it's sensible to begin conserving early. What you simply require to do is to begin with an attainable saving, plan your financial investments and also with a long-lasting commitment. The way you intend to spend your retired life completely rely on the quantity of cash you have saved and also invested.

Little Known Facts About Retirement Planning.

Satisfying their hefty medical costs and various other needs in addition to personal family need is truly extremely hard in today's age of high rising cost of living. retirement planning. For this reason, it is recommended to begin with your retirement cost savings as very early as you are 20 years old as well as solitary. The retirees present a substantial burden on their family members that had not planned and also saved for their retired life.

There's always a health and wellness concern related to growing age. There may be a circumstance where you can not function any kind of longer and the savings for retired life will certainly help to make sure that you are well cared of. So the big inquiry is that can you pay for the price of long-lasting treatment considering that it can be really expensive as well as is included in the expense of your retired life.

Do you desire to keep working after your retirement? The individuals that are not really prepared for retired life usually have to maintain functioning to accomplish their family's requirement throughout life.

The Buzz on Retirement Planning

If you start late, it might occur that you have to give up or readjust on your own with your pre-retirement as well as retirement way of life. The amount that you require to save and also include each period will certainly depend upon exactly how early you begin saving. Beginning with your retirement preparation in the twenties may seem prematurely for your retirement.

Moreover beginning early will enable you to establish excellent retired life cost savings and also planning practices and also provide you even more time to correct any blunder and also to identify any type of shortage in achieving your goal.: Capture up on your Retirement Planning in your 50s visit their website The retirement strategies should be made and carried out as quickly as you start functioning.

These economic organizers will certainly consider different variables to do retired life assessment which includes your revenue, expenses, age, wanted retired life lifestyle and so forth. Use the sweat of your gold years to provide a shade in your old days so that you depart the globe with the sensation of complete satisfaction as well as efficiency.

The 7-Second Trick For Retirement Planning

There is a typical mistaken belief among young workers, as well as it commonly seems something like, "I have lots of time to prepare for retired life. If you wait for the "ideal" great post to read or "best" time, you'll never ever begin.

The earlier you start, the better. It's never also late to start. With these two principles in mind, employees can be motivated to prepare for retirement immediately. Neither their age nor their present funds should be available in the means of retired life planning.

Not known Factual Statements About Retirement Planning

Much of us put things off occasionally also one of the most efficient individuals, obviously! When it comes to conserving for retired life, procrastinating is not recommended. Early birds don't just get the worm - they get five celebrity buffets for practically no effort. Allow's highlight the expense of laziness with a story retirement planning of three imaginary pairs.

As an example, based on data from the Office for National Statistics they had 6,444 of non reusable revenue per head in 1977. In 1982, they had 7,435 of disposable revenue per head. By 1987, they had 8,565 These pairs are all the very same age The vital difference between them is, they didn't all start to conserve for their retired lives at exactly the very same time.

They decided to save 175 per month (2,100 per year). 29 percent of their annual income. They got affordable mutual funds, putting 70 percent of their money in stocks, 30 percent in bonds.